Moneyball

Exploiting market inefficiencies...identifying undervalued assets...financial intelligence...spending within your means...creative money management...These were all tactics employed by one Billy Beane, General Manager of Major League Baseball's Oakland Athletics in the early 2000s, according to the book Moneyball: The Art of Winning an Unfair Game by Michael Lewis, which in 2011 was followed by a film of the same name. As one of the clubs with the league's lowest payroll, the author details how Billy Beane found a way to field a competitive team using the aforementioned methods, for starters. His approach was met with heavy criticism, including by members of his own organization. Despite the odds stacked against him, Beane's idea resulted in the A's making the postseason, leaving even the critical at heart pondering whether this strategy can work. Fast-forward to today Moneyball has become a major phenomenon, pioneering such terms as "analytics" where the baseball community is paying more attention than ever to stats and numbers, and factoring them into player/personnel decision-making. Corporate firms and entities are also getting involved; academic institutions are introducing "analytics" courses to their curriculum, and so forth.

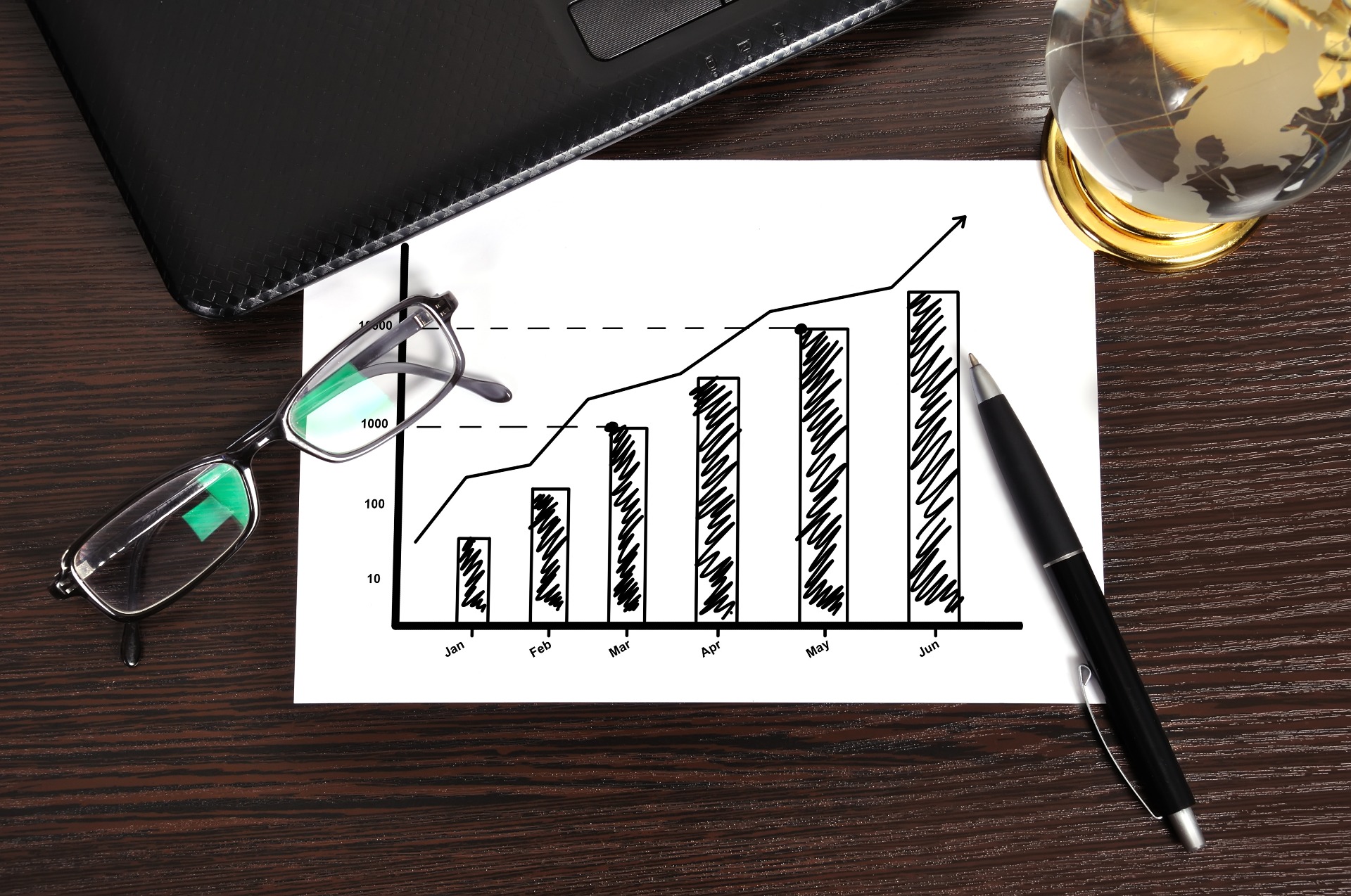

Among the many things stemming from the Moneyball tree branch, I find the approach toward Personal Finance most interesting. On a limited budget using creative money techniques, you can better control expenses to where suddenly it's not flying out your pockets. You have a chance to leverage expenses against each other - whether they be bills, consumables, you name it. At some point you recognize where your money goes serves a specific function, and with that comes how worthy of a transaction they are for you; now instead of buying and spending we're simply outlining tasks to be completed - you're evaluating money management in a different way. You find several transactions can be completed with little to no money at all, while the remainder can be done in micro-transactions - meaning no consumables and a mini-payment plan for purchases. In the end you identify opportunities to scale back, and eventually save some money- all while completing everything. The point here is you can control your money management habits by being willing to try something new and innovative. Billy Beane felt that way, which is how he went from the typical business-as-usual sports management grind to cross-referencing graphs and charts showing player stats and attributes to determine value, then being rewarded for it.

There are many things you can do in addressing what seems to be a critical life or business situation. Options can be weighed against one another, a process can be explored differently, loopholes may have yet to be discovered - bottom line is there's always the possibility of succeeding regardless of limitations. Michael Lewis tells how the A's did it, whether it came down to sabermetrics or unconventional scouting practices. Like Beane you also possess the ability to seek value and use it to your advantage. When facing a situation that presents the opportunity to try something inventive, don't be afraid to play Moneyball!

This article was written and edited by Cedric Denson as a product of CollegeWorld, LLC